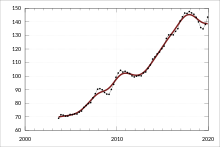

The Australian property market comprises the trade of land and its permanent fixtures located within Australia. The average Australian property price grew 0.5% per year from 1890 to 1990 after inflation,[1] however rose from 1990 to 2017 at a faster rate. House prices in Australia receive considerable attention from the media and the Reserve Bank[2] and some commentators have argued that there is an Australian property bubble.[citation needed]

The residential housing market has seen drastic changes in prices in the past few decades. The property prices are soaring in major cities like Sydney, Melbourne, Adelaide, Perth, Brisbane and Hobart.[3] The median house price in Sydney peaked at $780,000 in 2016. [4] However, with stricter credit policy and reduced interest from foreign investors in residential property, prices have started falling in all the major cities. [5] When compared with the soaring prices of 2017, the housing prices fell by 11.1% in Sydney and 7.2% in Melbourne in 2018.[6] In 2022 the residential rental market has seen a significant increase in rents, which has been described as a ‘rental crisis’.

- ^ Stapledon, Nigel. A History of Housing Prices in Australia 1880-2010. School of Economics Discussion Paper: 2010/18. Sydney, Australia: The University of New South Wales Australian School of Business. ISBN 978-0-7334-2956-9. Retrieved 1 May 2011

- ^ Monetary Policy

- ^ "Residential Housing Market Australia - Statistics and Facts".

- ^ "Median house prices in major cities in Australia as of August 2016 (in thousand Australian dollars)".

- ^ "Australian house prices down in every capital city except Adelaide and Hobart".

- ^ "Australian house prices falling at fastest rate in a decade".

© MMXXIII Rich X Search. We shall prevail. All rights reserved. Rich X Search